The Vital Process of Investing Off Coast for Financial Growth

Spending offshore can be a calculated step for financial development. It needs careful preparation and a clear understanding of one's economic goals and run the risk of appetite. Capitalists need to assess numerous markets and investment methods while taking into consideration legal implications. A well-crafted method that stresses diversification is important. Nonetheless, the complexities involved can commonly be testing. What actions should one take to browse this intricate landscape properly?

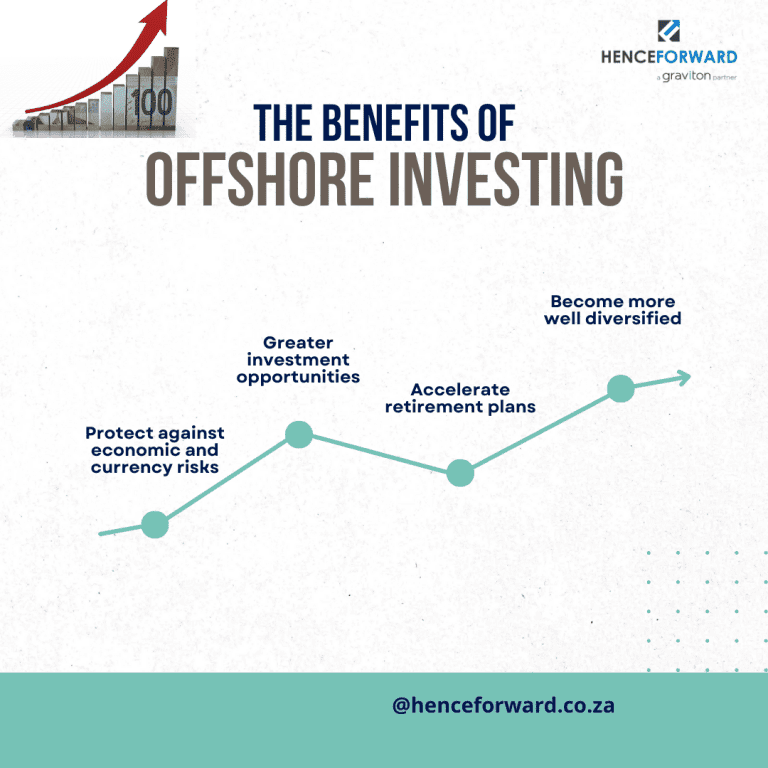

Understanding the Conveniences of Offshore Spending

The allure of overseas investing hinges on its potential for monetary development and diversification. Financiers commonly seek possibilities past their domestic markets, where they can access a more comprehensive variety of possessions and financial investment approaches. Offshore accounts commonly use advantages such as tax effectiveness, enabling people to maximize their total tax obligation responsibility. In addition, several offshore territories give a secure political and financial environment, which can decrease danger exposure.Investing offshore also allows people to hedge versus money variations and rising cost of living in their home country. This geographical diversification can enhance portfolio durability throughout market downturns. Overseas investments typically include access to exclusive funds and financial investment lorries that might not be offered locally. On the whole, the advantages of offshore investing prolong past plain resources gains, providing critical advantages that appeal to both seasoned and novice capitalists seeking to increase their horizons.

Examining Your Financial Goals and Threat Tolerance

Offshore spending presents various possibilities, yet success joints on a clear understanding of specific financial objectives and take the chance of resistance. Capitalists should first articulate their purposes, whether they go for funding preservation, riches accumulation, or earnings generation. Each objective requires a different financial investment method and timeline.Next, evaluating risk tolerance is important. This includes establishing just how much volatility a capitalist can stand up to and their psychological feedback to market fluctuations. A comprehensive danger analysis takes into consideration variables such as age, economic scenario, and financial investment experience.

Looking Into Possible Offshore Markets and Investment Options

Exactly how can capitalists properly identify the most encouraging offshore markets and investment alternatives? First, comprehensive market analysis is crucial. Capitalists ought to evaluate financial stability, development potential, and historical performance of numerous regions. Key indications such as GDP development rates, inflation, and joblessness statistics give insight into market viability.Next, comprehending neighborhood markets can uncover financially rewarding opportunities. Capitalists ought to concentrate on markets experiencing growth, such as technology, eco-friendly power, or actual estate. Connecting with financial consultants and regional specialists can additionally yield beneficial info concerning emerging trends and risks.Additionally, contrasting financial investment lorries, such as common funds, property, or supplies, helps in selecting the right choices. Capitalists must examine the liquidity and anticipated returns of each choice. By performing detailed research study, capitalists can purposefully position themselves within guaranteeing overseas markets, straightening their investment techniques with prospective economic development.

Browsing Regulative and lawful Factors to consider

Financiers going for success in overseas markets have to also bear in mind the legal and regulatory frameworks that control these areas - Investing Off Shore. Each jurisdiction features its very own set of legislations pertaining to taxes, reporting, and financial investment limitations, which can substantially influence success and compliance. Understanding these regulations is important for guaranteeing and preventing lawful pitfalls that investments are made based on local laws.Moreover, capitalists must know anti-money laundering procedures and know your customer (KYC) requirements, which differ by nation. Involving with neighborhood legal and economic consultants can supply important assistance, helping to browse complex regulatory landscapes. Additionally, remaining notified about any kind of modifications in legislation is crucial, as regulations can progress, affecting financial investment approaches. Ultimately, thorough research study useful content and lawful appointment are necessary for protecting an effective offshore financial investment, safeguarding both assets and compliance with worldwide laws

Creating an Effective Investment Approach and Keeping Track Of Progression

Crafting a robust financial investment method is crucial for attaining lasting monetary growth in overseas markets. Investors have to start by determining their economic goals, risk resistance, and investment horizon. This foundation enables the selection of ideal possession courses, such as stocks, bonds, or property, customized to the financier's special conditions. Diversification plays a crucial function in mitigating dangers while improving possible returns.Regularly keeping an eye on the performance of financial investments is similarly essential. Capitalists should set up a methodical evaluation procedure, evaluating portfolio performance against criteria and adjusting approaches as necessary. Utilizing technology, such as financial investment tracking software program, can promote this oversight and give valuable insights into market trends.Additionally, remaining informed regarding geopolitical occasions and financial shifts in offshore markets is crucial for timely decision-making. By preserving a self-displined method and adapting techniques as problems advance, investors can maximize their opportunities for financial growth.

Frequently Asked Concerns

Just How Much Money Do I Need to Start Offshore Investing?

Determining the amount needed to begin offshore investing varies substantially based on individual goals, investment types, and jurisdictions. Typically, capitalists need to take into consideration a minimum of $5,000 to $10,000 to effectively take part in offshore opportunities.

Can I Open an Offshore Account From Another Location?

Opening an offshore account from another location is feasible, relying on the monetary organization's policies. Commonly, customers can finish the required documentation online, yet confirmation procedures might require extra documentation to ensure compliance with regulations.

What Are the Tax Obligation Effects of Offshore Spending?

Tax implications of offshore investing differ by jurisdiction, usually involving complex policies - Investing Off Shore. Financiers might encounter coverage demands, prospective taxes on foreign income, and the need to abide by both worldwide and local tax legislations to stay clear of fines

Just how Do I Pick a Reliable Offshore Financial Investment Advisor?

Picking a dependable offshore investment advisor involves looking into qualifications, taking a look at client testimonials, examining experience in specific markets, and making sure conformity with policies. Credibility and openness are necessary elements to think about during the selection process.

What Currencies Should I Take Into Consideration for Offshore Investments?

When taking into consideration currencies for offshore investments, one ought to evaluate security, historic performance, and potential for development. Popular choices commonly include the US buck, Euro, Swiss franc, and emerging market currencies, depending on risk resistance and investment objectives. Furthermore, that site many overseas jurisdictions supply a stable political and economic atmosphere, which can reduce risk exposure.Investing offshore also makes it possible for people to hedge versus money fluctuations and inflation in their home nation. Overseas financial investments commonly consist of access to unique funds and investment lorries that might not be offered locally. Just how can capitalists properly determine the most appealing offshore markets and investment options? Crafting a robust investment technique is crucial for achieving This Site lasting economic development in offshore markets. Making use of modern technology, such as investment tracking software application, can facilitate this oversight and provide valuable insights right into market trends.Additionally, remaining educated about geopolitical occasions and financial changes in offshore markets is essential for timely decision-making.